This week saw the stock market debut of two major companies, LG Electronics India Ltd and Tata Capital Ltd. However, they witnessed contrasting fortunes on the opening day of stock exchanges.

While LG Electronics had a spectacular first day, opening at a 50 per cent premium over its initial public offering (IPO) price of Rs 1,140 per share, Tata Capital’s shares opened only marginally up. While Tata Capital’s shares opened only marginally up on Monday (October 13), LG had a spectacular first day on Tuesday, opening at a 50 per cent premium over its initial public offering (IPO) price of Rs 1,140 per share.

In fact, LG did so well that its market value crossed that of its South Korean parent firm.

Analysts attribute the home appliances and consumer electronics manufacturer’s exceptional listing not just to its attractive valuation compared to its peers but also the expectations of strong performance amid an economy-wide push to boost consumption.

Stars aligned for LG

According to Prashanth Tapse, Senior VP (Research) at Mehta Equities, betting on LG gave investors great opportunities for immediate growth as well as returns.

“Given LG Electronics India’s reasonable valuation and the robust Q3 (July-September) earnings expectations, investors had a clear visibility on the company’s business growth, and that’s reflected in the around 50 per cent jump in the listing price,” Tapse said.

The rally in the stock on its debut also underscores optimism around its ability to balance affordability with profitability through value engineering, local sourcing, and a favourable channel mix, said Chirag Jain, Deputy Head of Research (Institutional Equities) at Emkay Global Financial Services.

Story continues below this ad

“Investors also view LG’s India strategy as a microcosm of its broader global shift –focusing on scalable, high-margin categories and export-oriented growth,” Jain added.

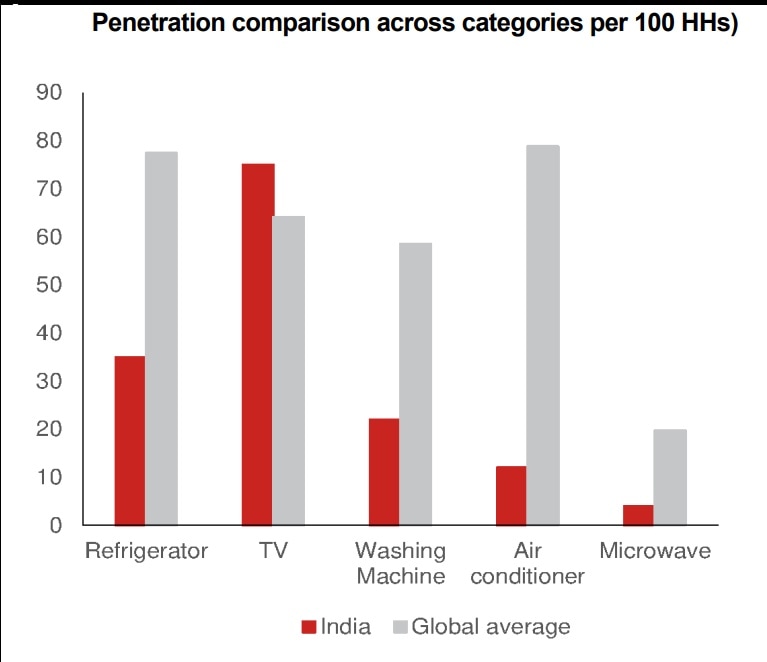

The government’s recent policy push towards consumption – income and Goods and Services Tax (GST) rates have been cut in 2025 – as well as peculiarities of the Indian market have further aligned stars for LG. According to Nomura analysts, penetration levels of white goods such as air conditioners, washing machines, and refrigerators are quite low in India compared to global standards.

“However, rising young/affluent user base, coupled with financing push and high latent demand (high average temperatures), is likely to sustain the strong penetration growth across categories,” they said in a note on Tuesday. Throw rising premiumisation into the mix and analysts expect LG to post handsome growth in revenues.

Comparison for appliances across categories.

Comparison for appliances across categories.

“We believe LGI’s strategy of focusing on mass premium, exports and B2B initiatives will drive growth with improving profitability,” Nomura analysts Siddhartha Bera and Kapil Singh said in a note.

Story continues below this ad

LG is dominant across multiple product categories and has the largest distribution and service network in India. In addition, its largest Indian plant – being built in Andhra Pradesh’s Sri City – is expected to begin production next year and its parent company “has a strong technology edge across motors, software, display etc and remains a key moat”, Bera and Singh added.

All in all, the future looks bright for LG. For Tata Capital, the picture isn’t as clear-cut.

A subdued market debut

As opposed to LG, Tata Sons-backed shadow lender Tata Capital’s first day on the bourses was far calmer, listing at a premium of 1.2 per cent both on the BSE and NSE, opening at Rs 330 compared to the IPO’s upper price band of Rs 326.

Mehta Equities’ Tapse attributed the weak listing of Tata Capital to a neutral-to-positive growth outlook for the non-bank sector. “In terms of immediate visibility, there were no triggers for NBFC as a sector to outperform. Moreover, there was no excitement factor in terms of valuation. Many analysts said that the Tata Capital’s valuation was cheap compared to Bajaj Finance or Cholamandalam Finance or Shriram Transport, but a price-to-book (P/B) ratio at 3.2x was considered expensive considering Tata Capital’s performance in the last financial year,” Tapse said.

Story continues below this ad

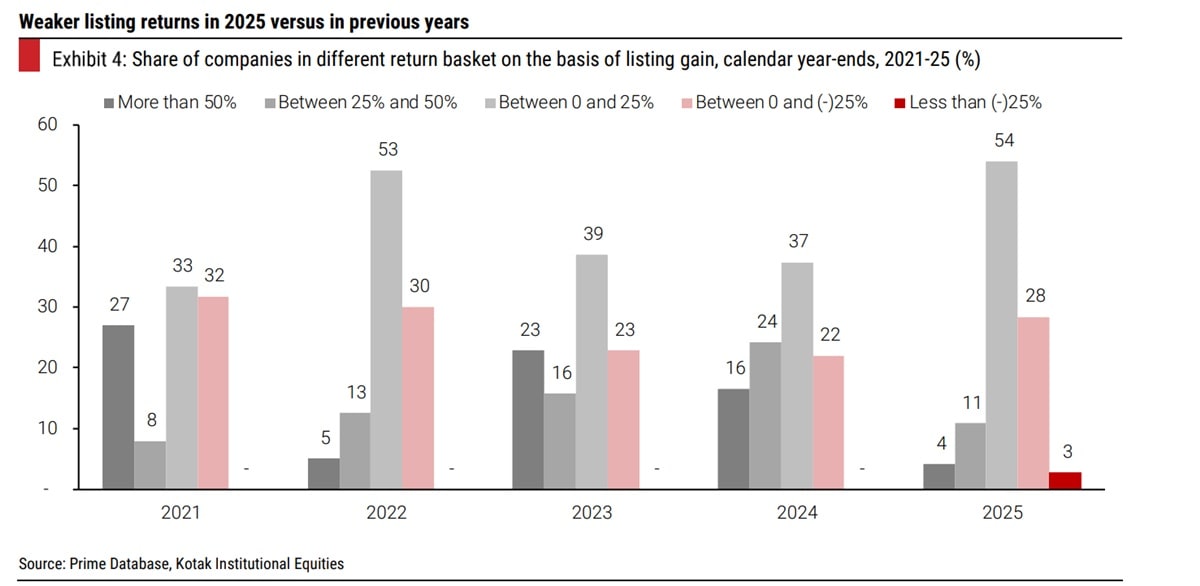

Chart on weak listings.

Chart on weak listings.

But performances in general have been subdued in recent times, according to analysts at Kotak Institutional Equities, with only 15 per cent of companies listed so far in 2025 delivering more than 25 per cent return compared to 41 per cent in 2024.

“Furthermore, over 2021-25, almost 27 per cent of companies listed below their issue price. Lastly, data shows that a significant proportion of companies failed to maintain their gains even after a decent listing. Currently, 38 per cent of companies are trading below their issue price,” Kotak analysts added on Monday.