Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

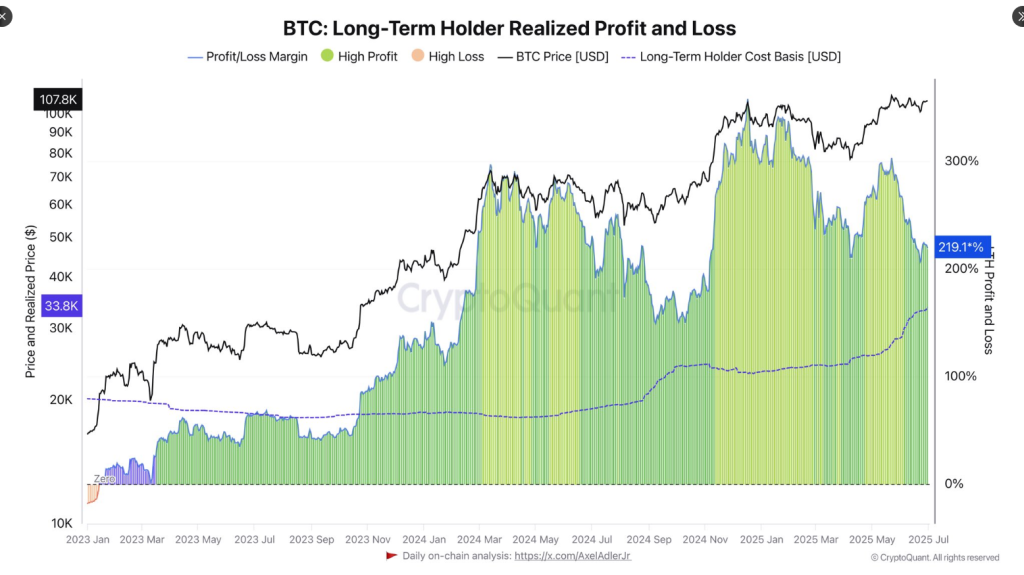

According to CryptoQuant analyst Darkfost, long‑term Bitcoin holders are sitting on unrealized gains last seen during the October 2024 market dip. Right now, those holders show an average profit of 220% on coins they bought and held for the long run. That figure is surprisingly low given Bitcoin’s recent surge back above $107,000.

Related Reading

Lower Profit Levels Than Previous Peaks

Darkfost used the MVRV ratio — market value relative to the average cost paid by long‑term holders — to track these shifts. In March 2024, when Bitcoin pushed up to $74,500, MVRV hit 300%. Then in December 2024, at the $108,000 peak, it climbed to 350%. By contrast, today’s 220% gain reflects the fact that many long‑term holders bought in at much higher levels than earlier in the cycle.

Price Needs To Rise To Match Past Gains

Based on an average cost basis of $33,800, Bitcoin would need to climb back to $135,200 just to restore that 300% profit level. If the market aimed to hit the 357% mark again, prices would have to reach roughly $154,400. Both figures track with what history tells us about investor behavior — people tend to sell when profits hit big round numbers.

📉 Unrealized profits of LTH continue to decline and are now approaching levels last seen during the October 2024 correction.

The average unrealized profit, based on the MVRV ratio, currently stands at around 220%.

That may seem high for BTC, but when compared to previous… pic.twitter.com/NeTCmXZVTY

— Darkfost (@Darkfost_Coc) July 1, 2025

Historical Cycle Comparisons

Looking farther back shows how much room remains. In December 2017, at the $19,500 top, long‑term holders saw unrealized profits of 4,000%. Then during the 2020/2021 cycle, Bitcoin spiked to $63,000 in April 2021 and MVRV topped out at 1,230%. By November 2021, prices hit about $68,400 but unrealized gains for long‑term holders had already fallen to 340%.

An analyst’s recent outlook lines up with this math, first pegging a cycle top at $135,000 in October 2024. After reviewing new data in May 2025, they revised the target range to $120,000–$150,000 and suggested a likely peak between August and September 2025. That range overlaps with the price levels needed to bring MVRV back to earlier highs.

Room For More Upside, But Watch The Risks

Based on latest figures, Bitcoin is trading at $106,750, roughly flat over the last 24 hours. Lower profit margins mean fewer long‑term holders are itching to sell right now, which could leave more fuel for higher prices. Still, on‑chain numbers don’t capture the whole picture. Spot-market flows, ETF moves and wider economic shifts can all trigger sharp reversals.

Related Reading

For now, the evidence points to a market that isn’t overheated. If Bitcoin follows past cycles, it may have farther to climb before long‑term holders lock in gains at levels seen in March or December 2024. But investors should balance these on‑chain metrics with real‑world signals — and be ready for whatever comes next.

Featured image from Imagen, chart from TradingView