Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

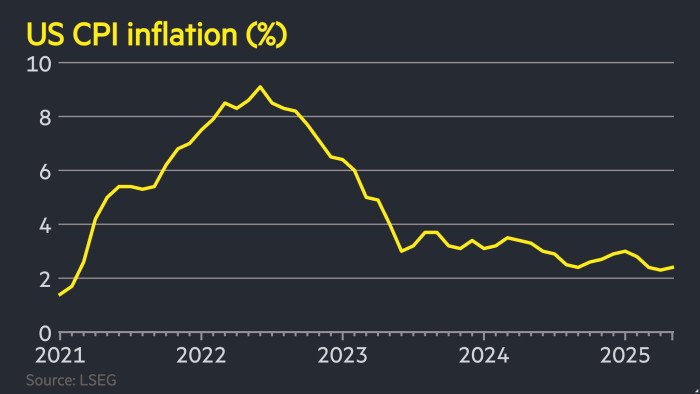

US inflation rose less than expected to 2.4 per cent in May, signalling Donald Trump’s tariffs are so far putting only modest pressure on consumer prices.

Wednesday’s annual consumer price index figure was below the 2.5 per cent predicted by analysts surveyed by Bloomberg, but above the 2.3 per cent recorded in April.

The core measure, which strips out changes in food and energy prices, remained flat at 2.8 per cent, against expectations of a slight rise.

“The boost to consumer prices from the tariffs remains microscopic for now, though that’s entirely in keeping with past evidence showing that retailers usually take at least three months to pass on cost increases to consumers,” said Samuel Tombs, chief US economist at Pantheon Macroeconomics.

Still, Daniel Hornung, senior fellow at MIT and a deputy director of the National Economic Council under former US president Joe Biden, noted that “it’s an encouraging report, but when you dig in a little bit a lot of what was encouraging about it was in categories, such as airfares, which are really not related to tariffs”.

In testimony before the House ways and means committee on Wednesday, Treasury secretary Scott Bessent said: “After four years of price increases diminishing the US standard of living, inflation is showing substantial improvement due to the administration’s policies.”

Inflation is expected to increase further in the coming months as the impact of Trump’s tariffs, which were unveiled in April, is passed on to consumers and businesses in the world’s largest economy.

The US currently applies a 10 per cent fee to most imports, as well as much higher levies on goods from China.

The US two-year Treasury yield, which generally moves with expectations for monetary policy, dropped almost 0.1 percentage point following the report to below 3.95 per cent. Stocks opened higher, with the S&P 500 up 0.1 per cent in morning trading on Wall Street, while the dollar index was down 0.3 per cent.

The US Federal Reserve is expected to hold borrowing costs at between 4.25 per cent and 4.5 per cent when it meets next week, in anticipation of further rises in inflation. Markets are pricing in two Fed rate cuts by the end of the year, with the first arriving in September or October.

“If inflation stays under control or the job market weakens, the Federal Reserve will likely consider cutting interest rates down the road,” said Alexandra Wilson-Elizondo, global co-chief investment officer of Multi-Asset Solutions at Goldman Sachs Asset Management. “We expect the Fed to remain on hold at next week’s meeting, but we see a path to a rate cut later in the year.”

Trump has heaped pressure on Fed chair Jay Powell to follow the lead of the European Central Bank and the Bank of England and cut borrowing costs this year, pushing for a full percentage point cut and calling Powell “a disaster”.

US vice-president JD Vance said in an X post on Wednesday following the inflation data that the Fed’s “refusal” to cut interest rates “is monetary malpractice”.

Eswar Prasad, professor at Cornell University, said he expected the “relatively benign” figure to trigger more calls from the White House for cuts, with economic and political pressures set to become “increasingly difficult to balance in the months ahead”.

The Fed’s preferred inflation measure, the personal consumption expenditures index, fell to 2.1 per cent in April, but is also expected to rise in the months ahead.