Key Notes

- The Hyperunit entity previously profited from shorting Bitcoin during Trump’s tariff announcement that triggered $19B in liquidations.

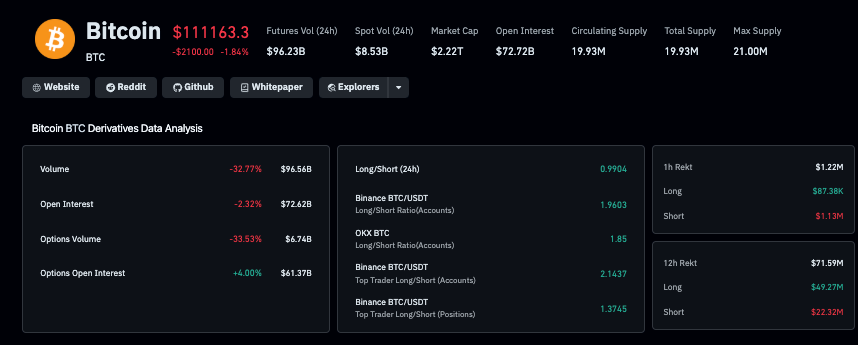

- Bitcoin futures volume plunged 32.77% to $96.56B while open interest fell to $72.62B as traders cut leverage exposure.

- Long-to-short ratio turned bearish at 0.99, signaling deleveraging as markets brace for Fed decision and government shutdown impacts.

On Oct. 15, blockchain trackers detected a $129 million transfer from a wallet cluster tied to the “Hyperunit” trading entity into Binance.

The entity, which manages over $10 billion in crypto assets, gained attention after successfully shorting Bitcoin

BTC

$111 043

24h volatility:

1.8%

Market cap:

$2.22 T

Vol. 24h:

$70.64 B

during Trump’s tariff announcement on Oct. 10, a move that coincided with over $19 billion crypto futures contracts liquidated, shaving off 9% from the aggregate sector market cap.

🚨 JUST IN: Bitcoin whale sends $129M to Binance

Same whale that shorted Trump’s tariff announcement is moving funds to Binance for what could be another big trade 👀 pic.twitter.com/HgzSvLnQ9r

— Bitcoin Archive (@BTC_Archive) October 15, 2025

Citing Arkham Intelligence data, news aggregator BTC_Archive speculated the whale’s latest transfer could be linked to another big trade ahead, potentially linked to key upcoming macro events including the next US Fed rate cut decision slated for Oct. 29 and the ongoing US Government Shutdown.

Bitcoin price was changing hands near $111,400 at press time, having traded within the 2% narrow range between $110,235 to $113,622.38 intraday.

Bitcoin Open Interest Dips to $72B as Traders Brace for Macro Volatility

Bitcoin currently trades at $111,169, down 1.62% on the day. With risk sentiment improving after global markets priced in a delay in further US tariffs, Bitcoin’s performance has lagged behind the S&P 500 for three consecutive sessions.

The predictive accuracy of the Hyperunit wallet’s recent bet on Trump’s tariff announcement could see BTC speculative market participants cut down leverage exposure, anticipating cautious sentiment for the coming trading sessions.

X user StockStormX noted that the Hyperunit whale may be preparing for a macro-related move to capitalize on Bitcoin’s recent divergence from the US equities markets.

Smart money moving to exchanges usually means action coming soon. If they nailed the tariff short they’re probably setting up another macro play. $BTC correlation with equities been breaking down lately so could see some divergence

— StockStorm (@StockStormX) October 15, 2025

Validating this stance, Coinglass’ derivatives data shows Bitcoin futures volume dropped 32.77% in the last 24 hours to $96.56 billion, while BTC Open interest declined 2.32% to $72.62 billion. Long to Short ratio also tilted bearish to 0.99, confirming rapid deleveraging in the aftermath of the Hyperunit whale’s latest transaction on Oct. 15.

Bitcoin Derivatives Market Data | Source: Coinglass, Oct. 15, 2025

Best Wallet Presale Surpasses $16.5M as Market Reallocates Liquidity

As large investors reposition across major exchanges, retail traders are turning attention toward new projects like Best Wallet (BEST).

Offering multi-chain support, smart vaults, and institutional-grade multi-sig security, Best Wallet is poised to gain more market share within the $26 billion custodial wallet market.

Best Wallet Presale

The Best Wallet presale has now surpassed $16.5 million, with tokens trading at $0.026. Investors can still join the presale through the official Best Wallet website to access exclusive early-entrant rewards.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.