Key Points

- Insiders are selling these stocks, but investors shouldn’t; there are reasons to expect higher share prices.

- Insiders have reasons to sell, but the results and analyst trends are leading the stock prices higher.

- The upcoming earnings reports will be a catalyst for these markets.

Insiders are selling stock in companies like Amazon (NASDAQ: AMZN), Chewy (NYSE: CHWY), and Carvana (NYSE: CVNA), but investors shouldn’t follow suit. The insiders have reasons to sell, including taxes and profit-taking, but investors don’t.

These stocks are performing well and have ample upside left, as indicated by the analysts. This is a quick look at what’s driving the action and what investors might expect from their stock prices by the end of the year.

Amazon Is the #1 Stock Sold By Insiders Summer 2025

Amazon is the #1 stock sold by insiders this summer on a dollar basis. Seven insiders made 24 transactions in the preceding 90-day period, putting their net activity at a two-year high in the first six weeks of Q3. However, the bulk of sales was made by founder Jeff Bezos, who still owns a significant stake in the company. His reasons include philanthropy, taxes, and his latest interest, space.

Mr. Bezos is investing heavily in space-oriented endeavors and will likely continue to sell AMZN stock. Recent results, which AI underpinned, are reasons why investors shouldn’t sell Amazon.

AI aided the core consumer and AWS businesses, driving better-than-expected results and a favorable outlook. The net result is that analysts continue to lead this market higher, issuing numerous price target increases following the release, forecasting a 17% upside and a new all-time high at the consensus target.

Dell Directors Take Profits in 2025

Dell (NYSE: DELL) stock is the second-most sold on a dollar basis for the summer of 2025. Insiders, including numerous directors, sold in 17 transactions, outpacing the buyers by a large margin, resulting in a one-year high for selling.

The caveat is that Dell stock has seen significant gains, rising over 100% since the April lows, 100% for the trailing two-year period, and 200% for the four-year lookback, with most sales driven by a single director. That is Silver Lake Capital, which still owns about 26% of the stock.

The takeaway is that this investment group, which has considerable skin in the game, is taking profits and may continue to impact the price action. The analysts are bullish on this stock and are increasing their stock price targets in 2025. They rate it as a Moderate Buy and see it advancing to long-term highs by the year’s end.

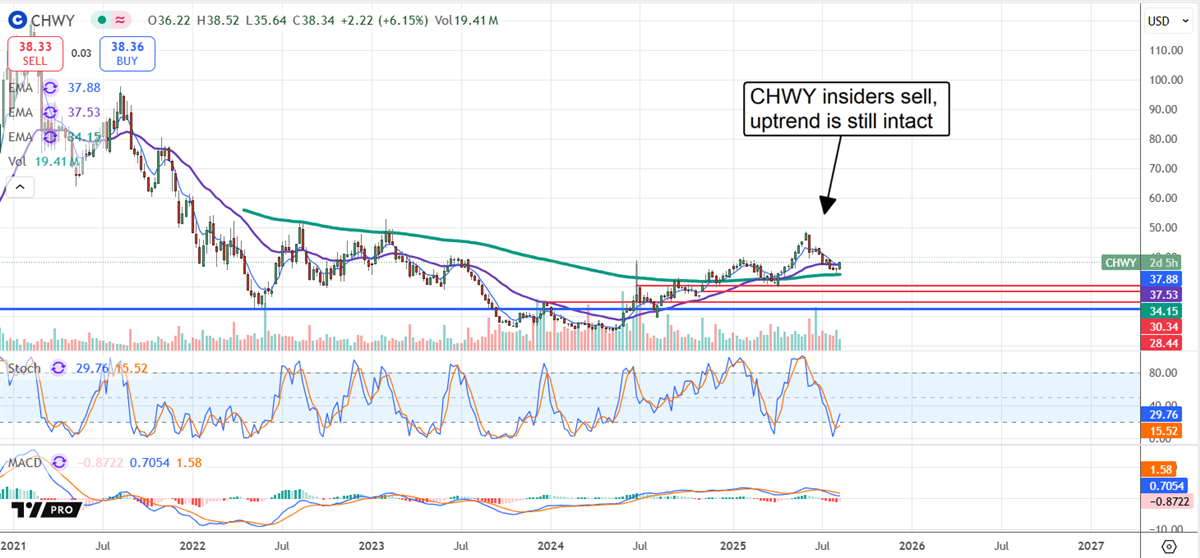

Chewy Insiders Sell: Uptrend Intact

Chewy is the third-most sold by insiders, with four selling in six transactions to set a multiyear high in selling activity. Their sales align with the stock’s summer price correction, which is good news for investors. The price correction put CHWY stock back at attractive levels where support is evident.

The August price action reveals support at the cluster of moving averages, aligning with the longer-term one-year uptrend and a complete market reversal.

The uptrend and late-summer reversal are driven by results, outperformance, improved guidance, and their impact on the analyst. The analysts’ trends are robust, including increased coverage, firming sentiment, and a leading trend in the price target forecasting 16% upside at the consensus.

Carvana’s Staunchest Supporters Sell in 2025

Carvana is ranked eighth in terms of selling volume, with sales dominated by its staunchest supporters: CEO Ernest Garcia III and his father. The two invested heavily in the stock at its lowest point and are now reaping the benefits. They and other insiders still own more than 15% of the stock, so they should be expected to continue taking profits as the stock price rises.

The stock price will continue to rise due to the results and analysts’ forecasts. The company accelerated its growth in 2025, outperforming by a wide margin, catalyzing an uptrend in analysts’ sentiment. They rate the stock as a Moderate Buy and forecast a move above $400.

Insiders Sell NVIDIA! OH NO!

Insiders, specifically CEO Jenson Huang, are selling NVIDIA (NASDAQ: NVDA) stock. The caveat is that Mr. Huang is selling following a prearranged trading plan in a stock that is up 100% in the last five months and multiple factors higher over the trailing four-year period.

Sales are expected to continue rising due to the stock price increase; investors should focus on his activity as much as the institutions and analysts, who are still buying this semiconductor stock.

Data from InsiderTrades reveals the institutions are buying robustly in 2025, netting more than $2 in shares for every $1 sold. Regarding the analysts, the trends remain positive as of mid-August, including firm coverage, steady sentiment, and an uptrend in the price target, forecasting another 35% upside at the high end.

Companies in This Article:

| Company | Current Price | Price Change | Dividend Yield | P/E Ratio | Consensus Rating | Consensus Price Target |

|---|---|---|---|---|---|---|

| NVIDIA (NVDA) | $181.62 | -0.8% | 0.02% | 58.59 | Moderate Buy | $185.97 |

| Carvana (CVNA) | $350.17 | +1.5% | N/A | 87.76 | Moderate Buy | $383.47 |

| Chewy (CHWY) | $39.40 | +8.8% | N/A | 44.27 | Moderate Buy | $43.78 |

| Dell Technologies (DELL) | $139.33 | -1.6% | 1.51% | 22.22 | Moderate Buy | $141.82 |

| Amazon.com (AMZN) | $224.66 | +1.4% | 0.09% | 34.25 | Buy | $262.45 |